It seems harder each day to keep your identity safe. Almost daily we hear about the next company that has fallen victim to a data breach. Taking a look back, 640 million consumer records were exposed in 2024 which includes Social Security numbers, address histories, and full names, according to Markets Insider. Research that has been provided by VPNRanks, predicts there to be 1,453 breaches in the Financial Services, Banking & Insurance industries alone by the start of this year. One thing you can do to keep your personally identifiable information protected, whether your information has been involved in a data breach or not, is to freeze your credit reports. An emphasis on the ‘s’, plural, – all credit reports! I will explain below.

There are three credit bureaus, Equifax, Experian, and TransUnion. It is their job to collect credit data and have reports on your credit history. According to Capital One, the data contained in each bureau’s credit reports can come from different origins so this is how there can be differences in credit reporting information among the three bureaus. With the different bureaus, some companies may check one, whereas others could use a different bureau. Each of these bureaus is a different company, and therefore, you must freeze your credit with each bureau. Below I will detail the steps on how to change your credit report with each bureau (on and offline).

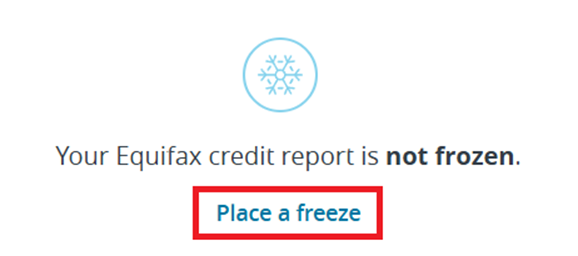

Let’s start with Equifax. To freeze your credit online, go to https://www.equifax.com and create an account, or login if you already have an account. Please note that you do not have to pay to become a member on any of these credit reporting sites, freezing, unfreezing, and viewing your credit report is free (by law everyone is entitled to one free credit report every twelve months from each of the three credit reporting agencies, according to the FTC, but now there is permanent access to free weekly reports). Right on the main page of the Equifax page, you will see your credit report status, it will read that it is not frozen, and here you can place a freeze by clicking the Place A Freeze link, as pictured below:

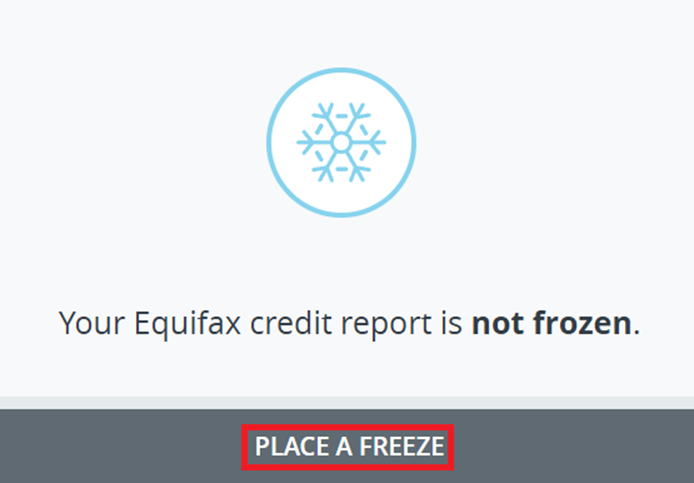

This will prevent access to your Equifax credit report so credit cannot be extended in your name. This will take you to another page that explains more about freezes and what they mean. You will need to click the Place A Freeze button on this page to continue processing the freeze, as pictured below:

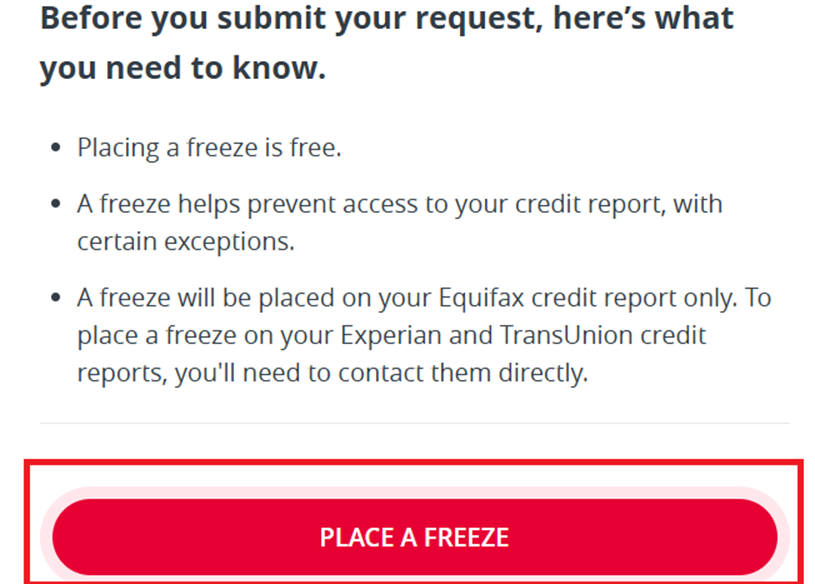

Finally, you’ll get to a screen that lets you know you are about to place a security freeze and what you need to know. You can then proceed to the red Place A Freeze button, pictured below:

On the next page you should receive a confirmation that the freeze was placed successfully as pictured below:

From this page you will also see links to both TransUnion and Experian credit reporting agencies, which you can use to link to next as we get ready to perform similar steps at the other two credit reporting agencies. You can also download a PDF confirmation that confirms your Equifax credit report has been placed in a frozen state, and I recommend you download this and keep it for your records. Great work! You have successfully placed your first freeze on the first out of three credit agencies. If you would rather not do this online, you can call and place the freeze by phone. Equifax’s Consumer Care team’s number is 888-836-6351. The Equifax Consumer Care team is available seven days a week from 8 AM through Midnight ET. They can also be reached by email anytime at customer.care@equifax.com.

Now we can move on to TransUnion at https://www.transunion.com. Again, you do not need to spend any money to create an account or place a freeze on your credit report. On the main page you can sign up for free, or login if you already have an account. They will ask you upon login to verify your information and that is a great time to update your address, email, or phone number if need be. On the dashboard, you will see the Credit Freeze box you can click on anywhere as pictured below:

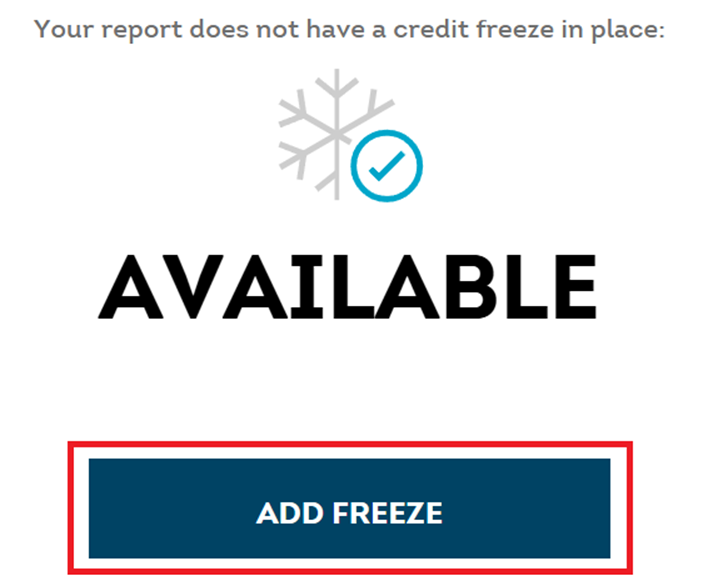

On the next page, it will inform you if you have a credit freeze or not. Next, click the Add Freeze button as pictured below:

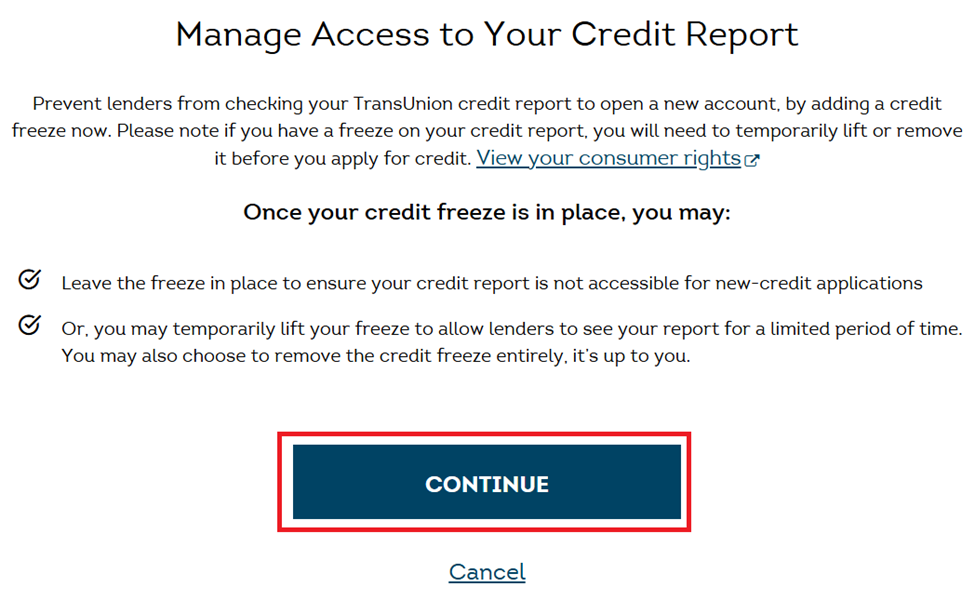

On the next screen that loads, you will see more information about the freeze and what your options are. Read these carefully to make sure you understand the process, but as explained above if you understand the freeze and want this for your credit, please hit the continue button, as pictured below:

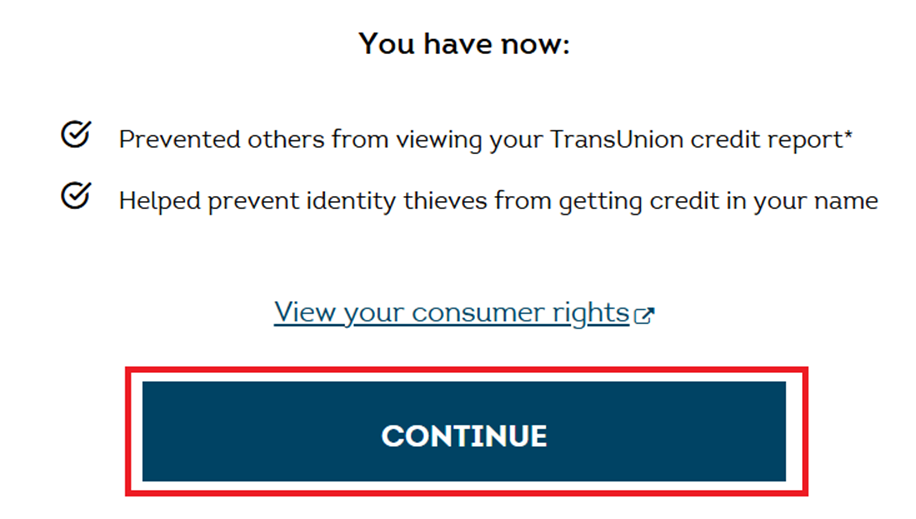

On the next page, you will see the confirmation that your freeze has been added. You can hit the continue button as pictured below once you are finished reading the information on the page:

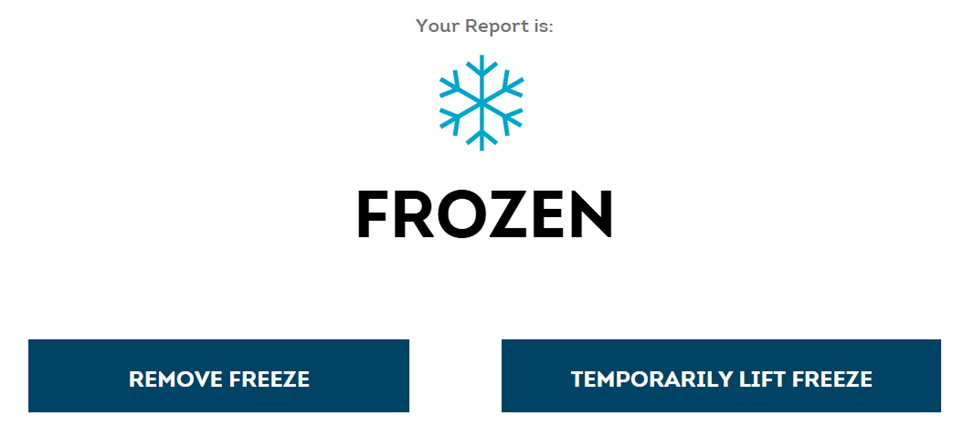

Once you hit the continue button, you will be brought to a screen that displays your new frozen status and from here in the future you can remove the freeze completely or temporarily lift the freeze if you need lenders to have access to your credit report, as pictured below. It is a similar process; just select the option you want and go through the confirmation steps.

To reach TransUnion by phone for an offline experience, you can call 866-744-8221.

The TransUnion support team is available Monday – Friday 8 AM – 9 PM Eastern Time and Saturday – Sunday 8 AM – 5 PM Eastern Time. They are closed on all United States observed holidays.

For our last credit reporting agency, go the Experian site to login here: https://www.experian.com/help/login.html. If it asks you to upgrade your membership to protect your privacy, this is not something you have to do to freeze or view your credit report. Select the box that reads, No, keep my current membership, as pictured below.

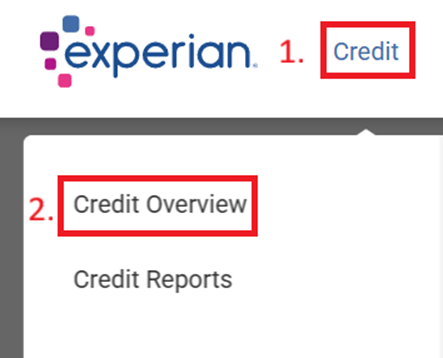

For Experian, you will have to dig a little for the freeze option, but at the top left hand side of the screen select Credit and then Credit Overview as pictured below:

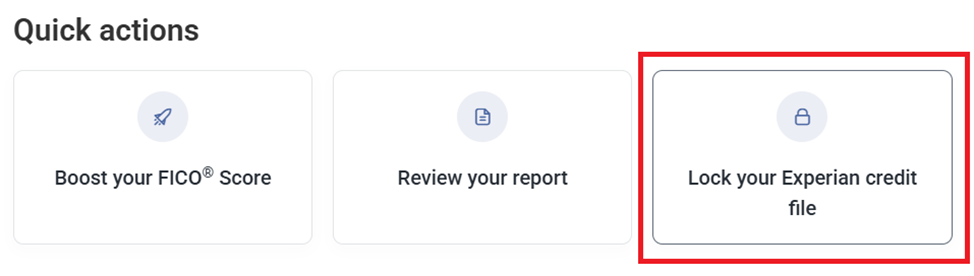

Next, scroll down a little and under Quick actions you will see an option to Lock your Experian Credit File, as pictured below. Go ahead and select this option.

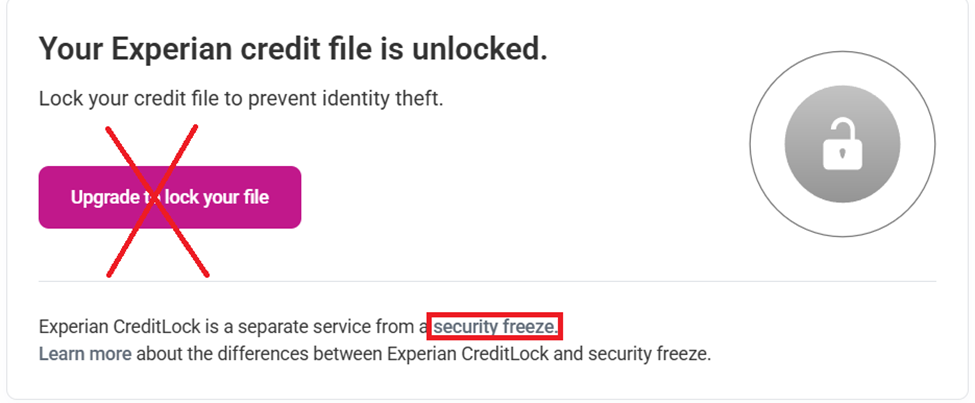

As mentioned, this one is harder to find, so this next step is important. You will be prompted to Upgrade to lock your file, but we are not interested in Experian CreditLock (which costs a fee). We want to initiate a security freeze, which is under the purple button and the link is worded security freeze – please see image below – it is not as easy to find here! You can click on the link titled security freeze to move the next step.

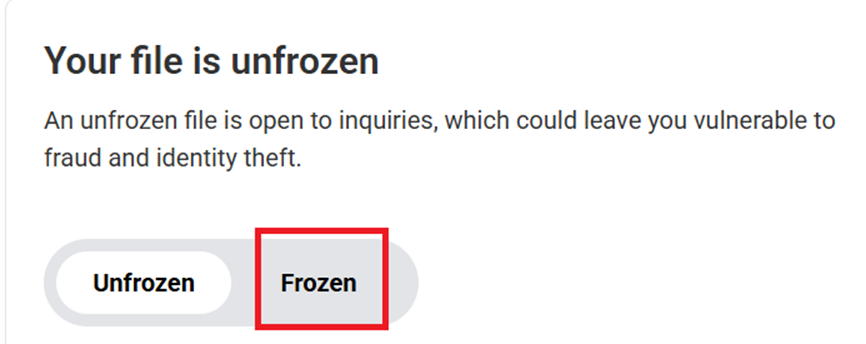

On the next page, it will tell you the status of your account. Simply hit the word Frozen to freeze your Experian credit as pictured below:

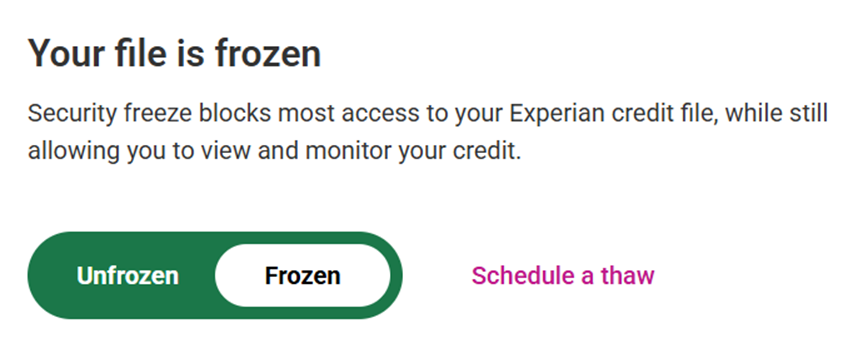

Next, you will get a pop-up in the bottom right corner of the page that your credit was successfully frozen, and the screen will update to this view pictured below:

You can call their number which connects you to their automated phone system at (855) 962-6943 with the hours of operation from Mon–Fri | 8am–8pm CT and Sat–Sun | 8am–6pm CT, if needed.

That wraps up how to freeze your credit reports on and offline! I hope you can feel more at ease now knowing that accounts cannot be opened under your name unless you initiate a thaw or completely remove the freeze! Until next time, from me here at the Life + Tech blog, happy living and teching!

References

Capital One. (2024). The 3 credit bureaus: Equifax, Experian, and TransUnion. Capital One. https://www.capitalone.com/learn-grow/money-management/three-credit-bureaus/?msockid=030d09a3d87e6bb211b61c3dd9796a0a

Ehtesham, H. (2024). Data breach statistics: A projected 4,306 Breaches by 2025 – How prepared are we? VPNRanks. https://www.vpnranks.com/resources/data-breach-statistics/#number-of-breaches

Federal Trade Commission. (2024). You now have permanent access to free credit reports. Federal Trade Commission. https://consumer.ftc.gov/consumer-alerts/2023/10/you-now-have-permanent-access-free-weekly-credit-reports

GlobeNewswire. (2025). TransUnion identifies increased risk for tax fraud linked to 970 data breaches in 2024. Markets Insider. https://markets.businessinsider.com/news/stocks/transunion-identifies-increased-risk-for-tax-fraud-linked-to-970-data-breaches-in-2024-1034443245

About Nichole

Welcome to my blog, where I blend my 12 years of IT expertise with a passion for cybersecurity and health and wellness. As a Master’s student in Information Security, I offer in-depth insights and practical advice on the latest in IT and cybersecurity. Additionally, I share valuable tips on maintaining a healthy work-life balance, inspired by my experiences as a mother of two, including raising a special needs child. Whether you’re a business seeking expert content or an individual looking for reliable information, my blog is your go-to resource for staying informed and empowered. Feel free to check out my services and contact me!